Insert Image of the Product: QuickBooks Financial Software

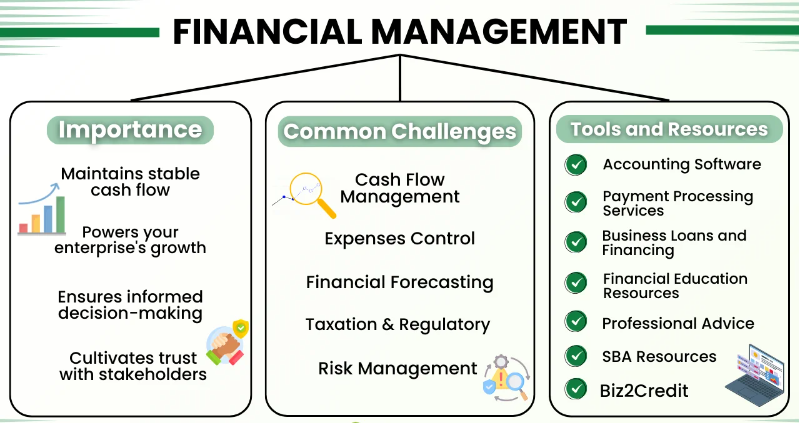

Business financial management is essential for any company aiming to streamline its financial operations, maintain cash flow, and achieve long-term growth. This involves using specialized tools that help manage expenses, revenues, payrolls, taxes, and other financial processes. Selecting the right financial management tool can be a game-changer for small businesses and enterprises alike.

Why Business Financial Management Tools Matter

Proper financial management not only keeps the business in good shape but also helps with forecasting and strategic decision-making. It involves tracking financial transactions, creating budgets, and ensuring compliance with regulations. By investing in the right tools, businesses can save time, reduce errors, and gain insightful data to enhance decision-making processes.

Best Business Financial Management Tools

Insert Image of the Product: FreshBooks Cloud Accounting Software

FreshBooks

<a href=”https://www.freshbooks.com” target=”_blank”>FreshBooks</a> is a leading cloud accounting solution, particularly useful for small businesses. It simplifies invoicing, expense tracking, time tracking, and reporting.

- Features: Easy-to-use interface, automated invoicing, and expense tracking.

- Pros: User-friendly, integrates with other apps, mobile accessibility.

- Cons: Limited for larger enterprises with complex needs.

- Price: Starts at $15/month.

- Use Case: Ideal for freelancers and small business owners who want a straightforward system to manage daily financial tasks.

- Where to Buy: FreshBooks is available on their official website or through software resellers.

Insert Image of the Product: QuickBooks Online

QuickBooks Online

<a href=”https://www.quickbooks.intuit.com” target=”_blank”>QuickBooks Online</a> is widely regarded as one of the best financial management software solutions for businesses of all sizes. It offers a range of features for tracking income, managing expenses, payroll, and generating financial reports.

- Features: Advanced reporting, multi-currency support, integrates with many third-party applications.

- Pros: Extensive features, excellent customer support, scalability.

- Cons: Can be complex for beginners, slightly expensive for small businesses.

- Price: Starts at $30/month.

- Use Case: Great for medium to large businesses that need a comprehensive financial solution.

- Where to Buy: You can purchase QuickBooks Online from their official website or leading software vendors.

Insert Image of the Product: Xero Accounting Software

Xero

<a href=”https://www.xero.com” target=”_blank”>Xero</a> is another cloud-based accounting software designed to help businesses stay on top of their finances. It offers a variety of tools to manage bookkeeping, invoicing, and payroll.

- Features: Dashboard overview, real-time updates, seamless bank reconciliation.

- Pros: Simple to set up, integrates with over 800 third-party apps, highly scalable.

- Cons: Learning curve for advanced features, some reports lack customization.

- Price: Starts at $13/month.

- Use Case: Suitable for small to medium-sized businesses that want a flexible, cloud-based solution.

- Where to Buy: Xero can be bought directly from their website or through licensed distributors.

Insert Image of the Product: Zoho Books

Zoho Books

<a href=”https://www.zoho.com/books/” target=”_blank”>Zoho Books</a> offers robust accounting tools with features like financial reporting, tax management, and automation for recurring payments.

- Features: Time tracking, project accounting, bank reconciliation.

- Pros: Affordable, extensive features for small businesses, integrates well with Zoho apps.

- Cons: Limited integration with non-Zoho products, not suitable for very large businesses.

- Price: Starts at $10/month.

- Use Case: Best for small businesses that use other Zoho products and want a seamless integration.

- Where to Buy: Available directly from Zoho’s official website.

Insert Image of the Product: Wave Financial

Wave

<a href=”https://www.waveapps.com” target=”_blank”>Wave</a> is a free financial management tool tailored for small businesses and freelancers. Despite being free, it offers a wide range of services, including invoicing, payroll, and receipt scanning.

- Features: Free accounting tools, invoicing, receipt management.

- Pros: Free to use, easy to set up, integrates with payment systems.

- Cons: Limited to small businesses, customer support is not as robust as paid tools.

- Price: Free, with optional paid features like payroll processing.

- Use Case: Ideal for freelancers or small businesses needing basic financial management without a hefty price tag.

- Where to Buy: Sign up for free on Wave’s official site.

Key Benefits of Using Business Financial Management Tools

Improved Accuracy and Reduced Errors

Financial management tools automate complex tasks like data entry and reporting, minimizing human errors. This is especially important when dealing with taxes and payroll, where mistakes can result in financial penalties.

Real-Time Financial Data

These tools offer real-time financial insights, helping businesses make data-driven decisions faster. Cloud-based systems like FreshBooks and Xero enable users to access financial data from anywhere, fostering remote work and collaboration.

Time-Saving Automation

Many financial tools come with automated features such as recurring billing, payroll processing, and expense categorization, which significantly reduce the time needed to perform these tasks manually.

Scalability for Growing Businesses

As your business grows, software like QuickBooks and Xero scale effortlessly, allowing you to manage more complex financial operations without the need to change tools.

Comparison: Which Tool Should You Choose?

- For Freelancers & Small Businesses: FreshBooks and Wave are excellent choices due to their simplicity and affordability. FreshBooks has more features, but Wave offers a free solution with essential tools.

- For Medium to Large Businesses: QuickBooks Online is a robust solution with extensive features for more complex needs, while Xero offers excellent third-party integration and a user-friendly interface.

- For Zoho Users: If you’re already using Zoho’s suite of products, Zoho Books is the best choice due to its seamless integration and affordability.

Where and How to Buy

You can purchase most of these tools directly from their official websites, where they offer various plans tailored to different business sizes. Always check for special promotions or trials, as most platforms offer free trials or discounted first-month pricing. For example:

- FreshBooks: Sign up directly from their website for a 30-day free trial.

- QuickBooks Online: Available for purchase from their official site, often with discounts for new users.

- Xero: Offers a free 30-day trial through its official website.

- Wave: Free to use with no paid subscription needed, but additional features like payroll are available for purchase.

FAQ

1. What is the best financial management tool for small businesses?

FreshBooks and Wave are great for small businesses due to their ease of use and affordability. Wave is free, while FreshBooks offers more advanced features.

2. Can I integrate my financial management tool with other apps?

Yes, many tools like QuickBooks and Xero offer integration with hundreds of third-party apps, making it easy to connect them with your existing business systems.

3. How do I choose the right financial management tool for my business?

Consider the size of your business, your budget, and specific needs such as payroll, tax filing, and integration with other tools when choosing a financial management tool.